As the dust settles in the aftermath of the economic crisis, we are left to contemplate the nature of the shock that hit us in 2008. Much of the initial debate concerned the ethics of the financial sector: many of the world’s most powerful institutions had been at best naïve and at worst thoroughly perverted by greed, cultivating an incentive system that stimulated risk-seeking behavior in general and the development of increasingly complex and intractable financial products in particular. It was during the public trial of the Wolf of Wall Street, by pundits and politicians alike, that the scope of the public debate gradually broadened to include other suspects. One of those suspects has proven to be particularly elusive: the science of economics itself.

The financial sector, so the argument goes, had been mandated to use increasingly complex and intractable models by an economic science that had become more and more divorced from its subject matter. Economics and its models no longer tried to make sense of our reality, but instead postulated a new one – a reality of a highly mathematical nature. Correspondingly, the 21th century economist preferred the formal qualities of models to the actual economic world it was taken to represent; the discipline worshipped the method and lost track of the end goal. In the now famous words of Paul Krugman, economists “mistook beauty, clad in impressive-looking mathematics, for truth” (2009). And so, the critics conclude, the discipline had fallen for mathematical rigidity and physical predictability, too much in love to notice that their subject matter was fundamentally different.

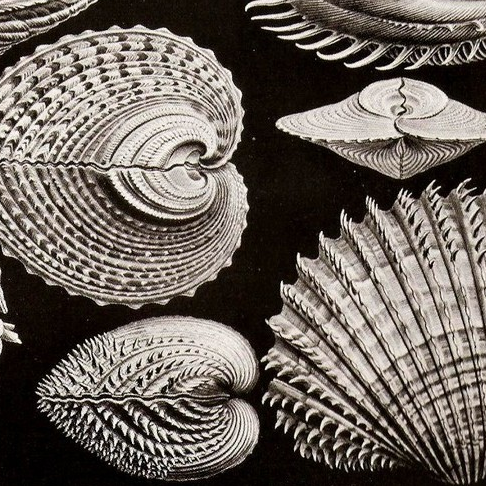

This line of reasoning gives rise to interesting questions. What is the influence of mathematics on the discipline of economics? Can there be such a thing as too much mathematics in economics, and if so, is that currently the case? In order to get a better understanding of these questions and possible answers, it is helpful to ask how mathematical tools entered the economic discipline in the first place. Over the course of the next few weeks, the Shells and Pebbles post series on the History of Mathematics in Economics will delve into these questions by looking at three different historical accounts of different instances of the mathematization of economics. The fourth and final contribution will compare these three cases, and relate their insights to the use of mathematics in economics today.

Today’s post discusses the most talked-about book on the relation between physics and economics: Philip Mirowski’s ‘More Heat than Light’.

Philip Mirowski: How Neoclassical Economics is just a Bad Copy of Physics.

Mirowski’s challenging thesis is that many of the most important innovations of 19th and 20th century neoclassical economics are based on models and theories from physics, in particular those that take the law of conservation of energy as their starting point. Economists such as Walras, Jevons and Fisher applied these models and theories to economics without understanding them well, and did not acknowledge that they were often unsuitable for the subject matter.

According to Mirowski, understanding economics in the nineteenth and early twentieth century begins with understanding the law of conservation of energy in physics. The principle of the conservation of energy has a complicated history, in which Mirowski distinguishes the following concepts:

“(1) the formation of a concept of energy; (2) an ontological claim that there was an energy “out there” and “in here” waiting to be found; (3) the mathematical statement that this energy is neither created nor destroyed; and (4) some procedure of justification for ideas (2) and (3)” (Mirowski 1989, p. 50).

The law of the conservation of energy, as we know it, is a composite of these ideas and allowed physicists to build models with interesting formal characteristics. In particular, it allowed physicists to represent the behavior of total energy in a closed system as a closed Hamiltonian model: all energy that was given up by one entity in the system had to be absorbed, in one form or another, by the other entities in the system. If we assume a system with only kinetic and potential energy, it would in principle be possible to discover the development of the system from its current state to any future state.

Mirowski argues that the idea of an unchanging ‘something’, on the basis of which we could judge the developments of its inner parts, took a hold of physics. He calls the range of physical theories that accepts rational mechanics and the energy concept, but does not yet incorporate entropy and later ideas about energy, the ‘ proto-energetics’ movement (p. 63). This demarcation of physical theories under the header of ‘proto-energetics’ is the protagonist in his discussion of the relation between physics and economics.

Irving Fisher

An exemplary individual in this context is Irving Fisher (Mirowski, p. 222-231), the famous physicist-turned-economist who wrote his dissertation with the thermodynamicist Josiah Willard Gibbs. Fisher was convinced that economists could learn important lessons from physics. One of the clearest manifestations of this belief is a table that sketched the economic counterparts of some central concepts from physics: energy was translated into utility, and particles resembled individuals; force was marginal utility (both represented as vectors), kinetic energy was total expenditure, the conservation of energy resembled the conservation of utility plus expenditure, etcetera.

To support his translations, Fisher assumed that the economics was also formally similar to physics, and derived conclusions for ‘utility’ that were similar to those that physicists had drawn for ‘energy’. Firstly, he represents utility as according to a ‘field theory of value’, which holds that utility can be represented as analogous to the field theory of forces in physics. In physics, this meant that forces were represented as vectors that stand for potential displacement. In economics, this meant that marginal utility was represented as a potential change in utility, given a change in income; if I would have one euro more to spend, in what way would my basket of commodities change? The different baskets of goods for which one’s utility is the same are connected by the so-called indifference curve, which is orthogonal to these vectors. Secondly, budget and prices together formed the constraint under which utility was maximized. Given a particular budget and particular prices, only a particular combination of goods is available to a consumer. The behavior of the consumer can then be described as the combination of goods out of this constrained set that meets the indifference curve.

According to Mirowski, this translation from physics to economics was problematic, for two kinds of reasons. Most importantly, Fisher’s translation did not work: because the nature of physical and economic phenomena is completely different, the application of physical models to economic phenomena created many inconsistencies that Fisher and those after him couldn’t solve. One example is that the law of conservation of energy, in Fisher’s model, translates to the law of conservation of utility plus expenditure (Mirowski, p. 230-231). This implies that money and utility are the same ontological entity, and that seems implausible. Besides, Mirowski holds that economists were, by and large, not very good at physics; and Fisher, despite his training in physics, seems no exception. Mirowski claims that Gibbs probably made a point out of the absence of a proof of the integrability of economic systems. This integrability was, in physics, a requirement for the use of closed Hamiltonian systems: only a closed Hamiltonian system allows us to say that all energy given off by one entity must be absorbed by another, because in an open system it could go anywhere. Economists, Fisher included, had not given a proof for the integrability of their systems. Mirowski suggests that Gibbs “probably” pointed this out to Fisher, but that Fisher did not see the point in it.

Dead tissue

Mirowski’s account of Fisher presents him as a thinker whose great ambitions exceeded his sense for the appropriateness of the metaphor as well as his skill in applying it. Fisher’s attempt to apply physics to economics was not primarily inspired by the subject matter of economics, but by the elegance of physics.

Mirowski concludes that economic theory of the time was a rotten copy of a physics metaphor; it was faulty to begin with, and has never been repaired because its engineers lacked the necessary skills. The underlying assumption is that the original context in which a mathematical tool is discovered is never completely lost when the tool is applied to a new context: a kind of mathematics that was developed with the purpose of insight in the different forms of energy will, when it is applied to a different field, carry with it bits and pieces of the substantive assumptions of the original context.

Consequentially, the use of a mathematical tool from physics in a new field such as economics will always introduce semantic content from its genesis. According to Mirowski, this can have grave consequences:

“[H]owever coy and ambivalent neoclassicals may appear to be about their physics metaphor, it cannot seriously be repudiated or relinquished, because there is nothing else that can hold the neoclassical research program together. In the absence of the metaphor of utility as nineteenth-century potential energy, there is no alternative theory of value, no heuristic guide to research, no principle upon which to base mathematical formalism, no causal invariant in the Meyersonian sense, and most threatening, no basis for the claim that economics has finally become scientific.” (p. 368, his emphasis)

Not only has the physical metaphor of energy and its conservation permeated economics deeply; economics depends on physics to such an extent that cutting out the dead tissue would strike the discipline in at its heart. For the endeavor of this series, it should be emphasized that this has consequences for the use of mathematics as well. If we follow Mirowski, the energy metaphor is the necessary condition for the use of a particular kind of mathematics in economics; the kind of mathematics that we now use to make sense of terms like ‘value’ and some aspects of ‘choice’. On Mirowksi’s terms, cutting the cord with the physical metaphor of energy conservation dissolves the ground on which our economic understanding of these terms is based.

We have seen how Philip Mirowski sees a pervasive physical influence behind the use of mathematics in economics. Economists borrowed from physics for the wrong reasons and in the wrong way, a mistake that today’s economist face the consequences for. If Mirowski’s description of Fisher is representative for the use of mathematics in economics, the picture would be ominous indeed. Unsurprisingly, considering the briefly sketched account above, a vivid discussion was evoked by Mirowksi’s controversial thesis. The next post in the series will introduce an account by Marcel Boumans, who uses the example of Jan Tinbergen to explain how economics has drawn on physics in a formal, rather than substantive manner. Contrary to Mirowski, Boumans holds that economics can learn from physics without introduces unwanted bits and pieces of substantive theory.

I am grateful to Ivan Flis for helpful suggestions and corrections in producing this blog series. The paper from which this series is derived was written under the supervision of professor Geoffrey Hodgson (University of Hertfordshire), and has benefited greatly from his commentary.

o-o-o

Manuel Buitenhuis is a graduate student at the University of Utrecht (MSc History and Philosophy of Science) and the Erasmus University Rotterdam (MA Philosophy and Economics). He holds a BA-degree from University College Utrecht, where he mainly studied economics and philosophy.

Bibliography

Fisher, I. (1926). Mathematical Investigations into the Theory of Value and Prices. New Haven: Yale University Press.

Krugman, P. (2009, September 2nd). www.nytimes.com. Retrieved June 8th, 2014, from The New York Times: http://www.nytimes.com/2009/09/06/magazine/06Economic-t.html?pagewanted=all&_r=0

Mirowski, P. (1989). More Heat than Light. Cambrdige: Cambridge University Press.

Image credits:

http://www.freeimages.com/photo/155598

http://en.wikipedia.org/wiki/Irving_Fisher#mediaviewer/File:Irvingfisher.jpg